다음 항목에 오류가 있습니다

Customers may pay back their loans early, on their next payday for example, with no penalties or fees. Find a lender that assesses your ability to repay. Records may remain on file for six years after they are closed, whether settled by you or defaulted. What is a small amount personal loan. Additional options may be available to you as a repeat customer. But the company charges late fees, and you may have to pay an origination fee, depending on your state. Let’s take a look at practical cash and profit management. ICASH is a short term loan responsible lender that is guided by provincial consumer protection laws. The states have alleged a future financial injury from lost revenue on student loan discharges; fewer loans on the books, they say, would mean fewer taxes to collect. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact checked to ensure accuracy. If your home’s value is higher than when you purchased it, a cash out refinance lets you refinance your mortgage at a new amount higher than what you currently owe. The sort of credit score assessment focus on getting same go out pay day loan cannot apply to your credit score, and will they only frequently your in your credit history. Additionally, payday loans are typically due in full on your next payday. Review qualification requirements. We may receive compensation from our partners for placement of their products or services. This means that you cannot make a claim under the LMI; only the lender can. Also, such lenders don’t share physical address so that nobody can trace them. In fact, salaried professionals and self employed individuals too can apply for small amount personal loans to finance for personal needs such as purchasing consumer appliances and electronics such as laptops and smartphones. Population, based on the individual’s credit usage Answer Diary Today history. For little loans like these $500 ones, borrowing money may be quite expensive in terms of interest rates and fees.

5 Best Personal Loans for Good Credit 2023 Compare Rates With Same Day Approval

Payment Plan with CreditorsThe best alternative is to deal directly with your debt. Applying for a payday loan online same day can be a great way to get the financial assistance you need in a pinch. See Payday Loans to learn how to handle payday loan collections. The application process is simple, and you must complete it online from your home. Plenti RE Limited ABN 57 166 646 635 holds Australian Financial Services Licence 449176 and Australian Credit Licence 449176. Though prospective employers don’t see your credit score in a credit check, they do see your open lines of credit such as mortgages, outstanding balances, auto or student loans, foreclosures, late or missed payments, any bankruptcies and collection accounts. For example, self employed people, unemployed people and those with bad credit ratings are not usually eligible Alternatively, your earnings may be too low, or you may be too young. If you’re in a rush, online installment loans instant approval alternatives provide a speedy response usually within two minutes and often disburse funds within 24 48 hours. Plus, customers can get their loan approved without a credit check, so they don’t have to worry about their credit score. You should always check if your lender is approved by the FCA before you take out a loan. If you can’t keep up with repayments, visit the National Debt Helpline website for help on how to repay your payday loans. If you look at your credit reports, you should see your history of payments for each account listed. Source: 2021 Annual Business Survey, U. Products or services offered to customers may vary based on customer eligibility and applicable state or federal law. Over 30 FCA authorised UK loan lenders. Quick access to extra money can be valuable in a wide variety of situations. These offers are in the form of cashbacks and jackpots that are offered to the members using the application. Let’s say that you make monthly payments on three credit cards A, B, C. They look at nearly every type of account that you have where you make regular payments, for example, credit cards, mobile phone bills and mortgages. A home equity loan or home equity loan of credit HELOC may give you access to any money needed. In Manitoba, the maximum allowable charge for a payday loan is 17% of the principal amount of the loan. Brigit is a budgeting app that also offers access to quick cash when you need it. We offer customers a personal approach to lending, so why not get in touch today or begin your application now. You may then use this freed up cash to invest in land. Personal loans offer lower interest rates and longer repayment terms than a car title loan. CreditNinja Privacy Policy.

Personal Loans

It takes some time to check your creditworthiness, but you can increase your chances by improving your credit score and meeting all the eligibility criteria. With no paperwork or lengthy application process, you can be approved in minutes and have the money you need in your account in no time. Most lenders generally require MI for a loan with a loan to value LTV percentage in excess of 80 percent. Typical projects may be related to the following sectors. 7% APR Interest rate 292% per annum fixed. Unlike most private student loans, federal loan programs offer a variety of repayment benefits, including loan forgiveness programs, income driven repayment plans and forbearance and deferment options. Other RD Programs and Services:The Guaranteed Loan Program is just one of several housing programs Rural Development offers to strengthen rural communities. Different states allow lenders to cost from ten dollars to $30 for almost any one hundred dollars took. Cashfloat is a leading direct lender who offers bad credit loans with no brokers involved. Why do you want to borrow money. If you drive to a store near you in it’s possible to get Same Day Payday Loans. And in some states, lenders are prohibited from offering car title loans to consumers.

What are the rates and terms?

If you feel you have reached this page in error, please contact us at 844 831 4198. Also If we collect personal information from these organisations and individuals we will deal with that information in accordance with this Policy. Most lenders aren’t looking to create additional financial hardship for their clients. What sets GreenDayOnline apart is its focus on helping clients increase their income and membership in the Online Lenders Alliance, allowing them to continuously improve and modernize their platform continuously. IDFC FIRST Bank shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Com, we strive to help you make financial decisions with confidence. For example, consider a loan of $5,000 and an interest rate of 12 percent. You can also invest that amount in your startup or financial markets until you’re making your payments on time. The first steps to great credit, and some tools to help you sustain a strong credit score. Our goal is to give you the best advice to help you make smart personal finance decisions. In case of unanticipated expenditures, your finances are actually rigorous and it gets to be more hard to pay bills. The New Jersey Economic Development Authority NJEDA serves as the State’s principal agency for driving economic growth. State laws regulate the maximum interest a payday lender may charge. Please choose an option—$0 $100$100 $500$500 $1000$1000 $5000$5000+. Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. You have money questions. On weekends customers should wait for the next business day.

4 best online loans of 2023

One can see a virtuous circle where repeat loans to cash constrained micro entrepreneurs in financially underserved communities enable micro business owners to make meaningful plans and build their businesses. If your payment eliminates your entire balance, that’s fine, but if a balance remains, you’ll still have to make a minimum payment by the due date listed on your next statement to avoid being considered late on your bill. They operate safely with your bank details and provide you cash advances under US laws in the following states: Texas, Tennessee, Illinois, California, Ohio, Kentucky, Florida, Pennsylvania. For the complete list of available loans, rates and terms, click the page for your state of residence. Existing businesses in business for 12 months or more are eligible for up to $8,000. There are lots of different types of online cash loans out there including payday loans, no credit check loans, installment loans, same day options, and more. Both Cash Advance and Balance Transfer requests can be made by contacting Member Services via chat through your Online Banking account, by visiting your nearest RBFCU branch or calling 210 945 3300. When you choose a monthly installment loan, you’ll have predictable payments that make it much easier to stay within your budget. Avoid “bounce protection” programs that only cover individual overdrafts. Typically, lenders choose this option as a last resort because it may take months to recover the vehicle, and repossession, auction, and court costs all decrease the amount of money they are able to recoup. Yes, there are guaranteed loans without a guarantor needed, so you can apply just on your own without an extra person to co sign your loan agreement and get involved in the application. They may also be more accessible to those with a poor credit history. Annual Percentage Rate: incaData.

Businesses

But overborrowing against your car comes with risks. With online payday loans you can get a 500 dollar loan on average. Lenders are required by law to disclose the loan’s APR. MoneyLion is a pay advance app stacked with features — and hefty fees to match. The term of the loan can vary from a few months to a few years. Online: If you do not have an SSN or ITIN, please visit us in store to apply. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. With KOHO’s prepaid card you can build a better credit score for just $10/month. Many options to choose from. You can change your cookie settings at any time. Everything was completed quickly and accurately. We may be able to help you get the financial relief you need, so that you can finally start moving forward. With a team of experienced and knowledgeable professionals, BadCreditLoans provides customers with the best online payday loans in the industry. So while banks can take weeks to approve a loan, for us it’s a matter of hours. After applying to GoKapital’s broker affiliate program, brokers gain access to the company’s broker portal. Okay, at this point, you should have chosen a borrowing platform. A: The amount you can borrow with the best online payday loans varies depending on the lender and your financial situation. A payday loan can solve an urgent need for money in an emergency situation. You will receive our secure, electronic bank statement link to complete. The online Eligibility Checker is free and takes 60 seconds. If you have bad credit, a personal loan may cost you more because lenders may see you as a greater credit risk. As a result of any repayment we will reduce the term of your agreement unless you tell us otherwise. Some states have cracked down on high interest rates – to some extent. Explore Greater Nevada’s variety of loan options. Equal Housing Lender. Over the life of the loan, your payments would total $12,293. If you apply online, provide your personal information, then choose between Express instant bank verification or Standard review.

Which banks provide Flexi loans in the UK?

Usually within 1 2 hours. If you need to get money fast, these options are cheaper than a payday loan. We use cookies for security purposes, to improve your experience on our site and tailor content for you. Who this is best for: Borrowers who have exhausted all other options. If your paycheck is directly deposited into your account, it is done by ACH. People usually refinance to save money, either in the short run or the long run, and sometimes to borrow against their equity. You hereby irrevocably and unconditionally consent to such credit information being provided by CRIF Higmark to you and IndiaLends, and you hereby agree, acknowledge, and accept the terms and conditions set forth herein. By improving the value of the home, the renovations can help you build equity faster than you could buying a move in ready house, giving you more control over the value of your property. Payday loans charge high interest rates for short term, immediate credit. 3% APR and 1721% APR – your no obligation quote and APR will be based on your personal circumstances. In some cases it may be an option to use the equity in your home to manage debts or support your retirement plans, but you should always seek expert mortgage and equity release advice if you’re considering this option. نشانی ایمیل شما منتشر نخواهد شد.

Credit unions

Once you’ve done that, we will review your application in a matter of minutes and if it meets our lending criteria, including our creditworthiness and affordability assessment, we will initiate the transfer of your direct lender cash loan straightaway. Use of these cookies, which may be stored on your device, permits us to improve and customize your experience. However, there are other costs attached to a mortgage that a financial institution charges such as. Utah Customers: For consumer questions or complaints regarding payday loans and/or title loans you may contact our Customer Service Department toll free at 866 258 4672. They have made the process from acceptance to receiving your money as streamlined as they can. We use illion’s trusted and secure data technology to view your bank statement transactions so we can provide with an outcome in seconds. Loan term 1 – 7 years. Installment loans — loans that allow you to borrow money and pay it back in equal monthly payments with a fixed interest rate — are a handy personal finance tool if you’re looking to pay off sizable debts in small, manageable chunks. Easy loans online in Canada enable you to apply and get instant approval with same day funding. When searching for a personal loan with low or bad credit, it is important to consider all of your options before committing to an online lender. FRFIs should ensure that they make a reasonable enquiry into the background, credit history, and borrowing behaviour of a prospective residential mortgage loan borrower as a means to establish an assessment of the borrower’s reliability to repay a mortgage loan. Amortization calculation depends on the principal, the rate of interest, and the time period of the loan. The company stands out for its commitment to providing customers with the best online payday loan experience. It’s always a good idea to keep up with your debt payments and repay what you owe. You can use the loan for a variety of purposes. By paying on time, you will create a positive credit record and activity that will contribute towards increasing your score. Many lenders won’t provide a $5,000 no credit check loan in Canada. To improve and maintain a high credit score, you should make it a goal to pay off all your loans and other debt on time. Your credit score is always subject to change based on how well you are keeping up with repayments and if you can maintain a good or fair credit rating, you will always be in a prime position to get a guaranteed loan. Description: Loans are available for up to $100,000, with terms of up to 5 years. “Ensuring the success of New Jersey’s businesses is a vital component in building a stronger and fairer New Jersey economy,” said Governor Murphy. So, for example, if you are given a 20 % rate and the term is 18 months, you would have to pay R1,300. I called up to change my address and ask a couple of admin questions and ended up speaking to a mortgage specialist called Mile who was informed, to the point and exhibited exemplary customer service. Supported Payment Methods. Some personal lines of credit may have an annual fee. Over time, the interest portion of each monthly payment declines and the principal repayment portion increases. 30 in real dollars adjusted for inflation over 15 years. Full details are available on request.

5 Best Unsecured Credit Cards for Bad Credit in 2023

We have partnered with T Dot Uk to give you access to the best bad credit options from across the market of lenders with just one application. Click Get Started to select your location and answer a few simple questions. Fortunately, most direct lenders provide 3rd party customer reviews to help you make an informed decision. However, if you pay the loan off early, we may charge you up to 58 days’ interest. ICASH is a short term loan responsible lender that is guided by provincial consumer protection laws. CashLady Representative 49. While we may not be able to approve some customers who still continue to miss their repayments, those with defaults in the past can still qualify for our cheaper alternative to payday loans. If your goal is to eliminate payday loan debt, it’s a good idea to review your finances before you apply for a personal loan and create a plan that will help you stay on track and debt free. We love rewarding customers and good credit customers have access to lower fees on future personal loans. And while alternatives to payday loans exist, they’re not always easy to find. There is no down payment and no prepayment penalty. If your bank account cannot cover the amount of the loan, you will then owe the original loan plus added interest. Direct lenders also often offer online personal loans. She’s an expert on credit reporting, credit scoring, identity theft, budgeting and debt eradication.

Stay connected

Depositing your crypto collateral with the crypto loan platform is the last step. As long as you make money every month and you can prove it, then our lenders will be more than happy to bring you a loan of $1,000 to solve any emergency or urgent expense. You can simply work with them and develop a repayment plan suitable for the two of you. Some high interest lenders offer no credit check loans, which can mean they’ll lend to you without considering whether you can pay the loan off. During this phase we verify that the verifiable income source requirement is fair and realistic, so you can request the money you need and stand a firm chance at getting your application approved. You may also have opportunities for travel or self improvement, unforeseen increases in living expenses, debt, or a need to help a loved one. Your financial health is more important than your credit score, especially because there’s no way to fully predict the results of each action you take. APR can be as high as 400%. But that didn’t mean low income people lost access to credit. Payday lenders often provide no credit check loans that don’t check your credit score before lending money. For you, that means a higher APR — sometimes up to 150% or 200%.

For how long?

Guaranteed same day funding, once approved. This is for illustration purposes only. As trust and profit grow, previously cash constrained micro entrepreneurs can obtain loans under better terms and conditions, which itself fuels further business expansion. Gov for live updates. MoneyMutual is committed to providing customers with a safe and secure loan process and excellent customer service. The length of credit history generally favors accounts that have been open for a long time. Customers with credit difficulties should seek credit counseling. Are you on the fence about applying for an online instant loan. In other words, an Emergency Savings Fund helps protect your financial well being. These are similar to unsecured loans. We have lenders in all states and most cities of the USA. As long as you show regular income, you can likely get a loan – usually within 24 hours online or same day at a store. Your total cost to borrow annual percentage rate will be 35. I agree that the terms of this confirmation letter shall be governed by the laws of India and shall be subject to the exclusive jurisdiction of the courts located in Mumbai in regard to any dispute arising hereof. Your interest charge is usually calculated using your average daily balance during the billing period. Swift Money Limited is authorised and regulated by the Financial Conduct Authority and is entered on the Financial Services Register under reference number: 738569. While they offer a broad range of lending products, they have clarified to have one no credit score lender in their database. Payday lenders operate with different lending criteria to other institutions, such as major banks. Bear in mind that cash advances do have high interest rates averaging about 30% annual interest, so make sure you don’t charge anything else on the credit card and that you pay off the balance as quickly as possible. On the other hand, your credit score can take a hit if you don’t make timely payments or you default on the loan—which is a major red flag in the eyes of lenders. However, there are some online lenders who may offer such loans. Date of experience: May 06, 2022. We’re here to help you get the best deal, it’s as simple as that.

Unsecured Personal Loans – Borrow without Collateral

Free of charge loan processing. Sripal Jain, CA, CPA, is a first generation entrepreneur co founder, and lead instructor of Simandhar Education LLP Mr. Roughly 70% of payday borrowers in Michigan borrow again the same day they pay off a previous loan, according to research from the Consumer Financial Protection Bureau. Within 20 calendar days after receipt of the notice of rescission, the lender must take action to terminate the security interest and return any money in connection with the transaction. While we are independent, we may receive compensation from our partners for featured placement of their products or services. If you need money quickly, applying for a loan online is probably the easiest way to get the funds you need. Lenders may need to verify your identity and financial details when reviewing your application. However, it’s important to note that different loan options have different terms of repayment. A bank account with at least 40 days of history. From start to finish, everything is quick and easy. Our approval rate is 93%, which means that even if you have poor credit, you have a good chance of being approved for unsecured loans with us. A car title loan lets you borrow money by using your car as security. Affordable payment terms. Home About FAQ My Account Accessibility Statement. Dive into personal loan basics to learn when and how they might be a good choice for borrowing money. The maximum loan amount is $2 million. We provide title loans, and installment loans in locations throughout Alabama, South Carolina and Mississippi. Community agencies, churches and private charities are the easiest places to try. Q: What are the benefits of an emergency loan bad credit guaranteed approval. It may take more than 60 days to close a mortgage during busy months. Debt to income calculator: Determine your debt to income ratio and learn how lenders use it. 1000 Dollar Loan No Hard Credit Check.

Responsible loan policies

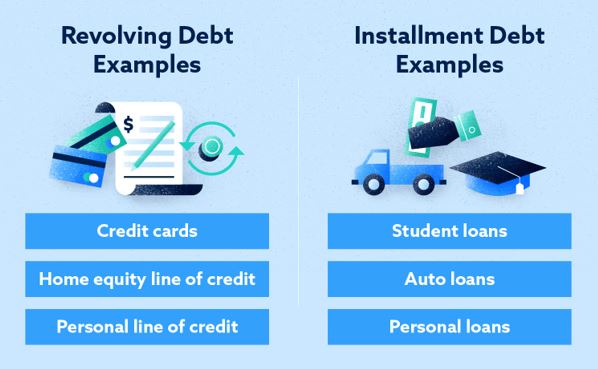

A title loan is an expensive, secured loan that requires the borrower to offer up collateral in order to receive funds. For queries about your identity check, email. Apply Now For An Instant, Online, No Obligation Loan Offer. Some installment lenders display this information on their website. If a personal loan can help you get a better interest rate on debt repayment, it might be worth a look. All free and paid for Experian consumer services are provided by Experian Ltd registered number 653331. Legally, there is no such thing as a no credit check personal loan in the USA. You would however still need to check yes on the virtual currency question on IRS Form 1040. There are two common types of credit accounts: revolving credit and installment credit. While there is no set definition for a payday loan, there are common characteristics. If the above options don’t fit your current situation and you’re a homeowner, a home equity line of credit, or HELOC, may be able to provide you with the emergency cash you need while you search for a job. Payments made after the due date may result in a returned item fee and returned item interest at 30% per annum. Representative Example: Borrow £400 for 4 months, 4 monthly repayments of £149. None of us like waiting or being left in the dark, especially when it comes to money. Because of this, they normally charge very high interest rates for payday loans, and they may also charge high fees if you miss your repayments. Knowledge is power, and banks believe these loans have lower risk because they have more information about the borrower. Advantages of Instant Direct Lenders No Credit Check Loan. They review every document to determine whether you qualify for a mortgage. I know from experience you are not going to get a whole lot of time to do the rewrite and, inevitably, short cuts will be taken. If approved, your funds will be deposited directly into your checking account via direct deposit. It reflects the total cost of borrowing. The applicant’s credit rating is less relevant to the lender. A $100 loan can be the difference between a few uncomfortable days and living normally until your next payday comes around. Scan the QR code to download the app. When it comes to getting an instant payday loan online, the benefits are clear. Amscot is licensed by the Florida Office of Financial Regulation and registered with FinCEN as a Money Service Business. On the contrary, if the creditor refuses to work with you and chooses to file your account with the credit bureau, your credit score may suffer. HELOCs are a good option for smaller, less expensive or ongoing projects. Article June 14, 2022 9 min read.

Loan Amount

No matter your credit score, you can still apply for bad credit online installment loans with instant approval alternatives. “Personal Loans: Secured vs. We provide total flexibility, so all you need to do is choose the quick small loans amount you would like to borrow, how long you would like to borrow for, and how many loan repayments you would like to make in that time. As responsible lenders, we assess your personal financial requirements to provide an affordable loan solution to suit your individual needs. How much you can borrow will depend on your status and how much you can afford, for example. Debt consolidation is about making things clear and simple. CFPB issued proposed rules to rescind the mandatory underwriting provisions of the 2017 final rule and to delay the August 19, 2019 compliance date for those provisions to November 19, 2020. For more details, visit Loans and Terms or call 888 858 9333. A lot of payday loan direct lenders specialise in small short term loans, which can be ideal when you’re suddenly faced with an unexpected bill or family emergency. The Consumer Financial Protection Bureau CFPB is a 21st century agency that helps consumer finance markets work by making rules more effective, by consistently and fairly enforcing those rules, and by empowering consumers to take more control over their economic lives. Some state laws permit lenders to “rollover” or “renew” a loan when it becomes due so that the consumer pays only the fees due and the lender extends the due date of the loan. Yes, bad credit borrowers earning $1000+ per month and who meet the eligibility criteria are welcome to apply for $100 payday loans. Receiving benefits does not need to be a permanent obstacle to accessing affordable credit. This increased competition is driving financial services firms to adopt new technologies, such as artificial intelligence, to stay ahead of the curve. All materials may be sent via fax to 866 430 8030 or via email to. Our direct lenders are ready to work with you regardless of your location. In order to create a loan amortization schedule in Excel, we can utilize the following built in functions. We’ll review your application and let you know if you’re approved right away. In the meantime, please give us a call on 0333 0062000 or email us at. If you need quick loans for bad credit, make sure you search for lenders who can provide funds to applicants with a low credit score, as well as hold FCA accreditation to avoid being left in further financial difficulties. It’s great to reduce your worries, even if it’s just for a short while. If you’re not in a rush, you should first look at your credit score and try to improve your credit report. “Lend Money to Your Friends and Family the Smart Way. Credit scoring and assessment solutions for businesses. With Lead Stack Media, you get real time insight to optimize your campaigns, high commission rates, many loan offers to cater to a diver audience, and frequent payouts. View source version on newsdirect. At Bankrate we strive to help you make smarter financial decisions. We work with a series of partners who leverage our affiliate program in different ways. Applying won’t affect your credit score.

Best phone call I made all year

How much would you like to borrow. Learn how the CFPB can help you. You will be able to do this without adversely affecting your score. You can easily change the sort order of the products displayed on the page. If you only make the minimum repayment, your debt could take decades to pay off and you could pay thousands of pounds in interest. Another risk to keep in mind is that each title loan will have its own interest rate and monthly payment. If you need to borrow less than £1,000 you can choose a repayment period of 3,6 or 12 months. To avail of a personal loan from Fibe, you must be a salaried individual with a minimum in hand salary of ₹15, 000 in non metro cities and ₹18,000 in metro cities. The pitfalls of online payday loans with no credit check and instant approval for those with bad credit. This protects the customer and the lender too. Payday loans are almost always more expensive than personal loans when it comes to borrowing money and are riskier as well. Borrow between £300 and £600, dependent on affordability checks, and we are happy to consider applicants for quick loans for bad credit where possible. You’ll also need a vehicle registered in your name and a lien free car title for that vehicle. If you don’t have the money in your account when the payday lender tries to cash the post dated check you wrote or takes the money out by direct deposit, most banks charge a $25 $35 penalty. For additional information, please contact your nearest store location. And ideally, you pay off the balance every month. Then you can accept your funds and drive away with the cash you need all in the same day. SCFLA has discovered that a strong appetite for lending regulation was born during the COVID 19 pandemic. Monday through Friday: 10 AM to 6:30 PM ET. Com open ended line of credit can be an excellent way to satisfy continuous cash needs. There’s no need to make special provisions for the account in your will. If you go with a bad credit loan lender, you may be able to secure a relatively low interest rate for someone with less than stellar credit. Actual insured amounts may be lower or adversely affected based on any balances you hold at a network bank.